A Legal Reading of the Israeli-American Policies towards Palestinian Authority Tax Revenues

Yousef Al-Ashqar*

On July 8, 2018, Israel passed a law to slash tax funds paid to the Palestinian Authority (PA). The law approved a deduction from the total amount of clearance funds (or tax revenues) transferred to the Palestinian Authority (PA). This deducted amounted is usually allocated to by the Palestinian Authority to the families of martyrs and prisoners in Israeli prisons. Thus, Israel began a monthly deduction of 50 million shekels, starting from January 2021.

However, Hussein al-Sheikh, Head of the PA’s General Authority for Civil Affairs, confirmed in a tweet on December 2, 2020, that the PA received all clearance funds. This was described at the time as an Israeli retreat from deducting tax revenues dedicated to the families of martyrs and prisoners. On the other hand, the Palestinian Authority sought, through several procedures, to change the method for paying salaries to Palestinian prisoners and those released, by integrating those freed among them as employees into official departments (e.g., the Ministry of Social Affairs).

In fact, this is not the first time that Israel seizes clearance funds or seeks to do so. But what is different this time is that Israel has seized Palestinian funds under to a law, thus making it seem a legally legitimate deduction.

To what extent can this Israeli move be described as legal considering the agreements between Palestine-Israel and under the relevant rules of international law? Also, what are the legal options the PA has in order to counter this Israeli move?

Clearance Funds are Palestinian Money

Clearing is a financial mechanism for settling commercial, financial and banking transactions between different persons and banks. The Paris Economic Protocol stipulated, in Articles (3), (5) and (6), a money transfer system between both the Israeli and Palestinian sides (Article 15). In this system, Israel collects funds and transfers them to the PA on a monthly basis in exchange for an administrative commission. The clearance funds therefore were considered purely Palestinian money. However, since the Paris Economic Protocol authorized Israel with collecting these funds, the Protocol has completely reinforced its control over the Palestinian economy.

The sources of those Palestinian clearance funds are three types of taxes:

- Direct taxes which include income tax on the wages of Palestinian workers in Israel and the settlements.[1]

- Indirect taxes,[2] which are taxes imposed on goods imported from Israel. These taxes are divided into (a) the value added tax on all the Israeli-imported goods, and (b) the purchase tax on oil derivatives, cigarettes and alcohol.

- Indirect taxes on goods imported from abroad. Israel collects these funds from Palestinians and returns them to the PA in exchange for an administrative fee of about 3% of the total collected funds. And the monthly average of that collected funds is about $53 million, an equivalent to 1.7 billion shekels.

The value of clearance funds, during the second quarter of 2020, according to the Palestinian Central Bureau of Statistics, amounted to 3,768,000,000 Shekels. This constitutes 63% of total PA public revenues in Palestine. It is important to note that over the last five years, Israel has deducted more than 12 billion shekels from the PA’s clearance funds.

The Deducted Tax Revenues Law: An Israeli Legislation to Seize Palestinian Funds?

Israel justifies its 2018-legislation of the deducted tax revenues law with its need to curb the Palestinian attacks it describes as terrorist. Thus, following an Israeli Minister of Defense report, which was based on monitoring the PA’s allocation of funds to the families of martyrs and prisoners,[3] the Israeli Ministerial Committee for National Security Affairs issued, on February 17, 2019, an order requiring the implementation of the Israeli law, i.e., the deducted tax revenues law.

Thus, in December 2018, an Israeli court deducted 13.2 million shekels from the Palestinian clearance funds to compensate Palestinian citizens acting as informers to the Israeli occupation, for damages, Israel claims, were inflected on them as a result of their imprisonment inside the PA’s jails.

Israeli deduction of clearance funds did not start with the enactment of the deducted tax revenues law. In fact, on several previous occasions, Israel seized PA’s clearance funds

Israeli deduction of clearance funds did not start with the enactment of the deducted tax revenues law. In fact, on several previous occasions,[4] Israel seized PA’s clearance funds. For example, Israel had withheld Palestinian money for two years (December 2000 to December 2002) because of ‘the events of the second intifada’. And this was the longest time it had withheld this money. Also, in 2006, after Hamas’s victory in the Palestinian legislative elections, Israel withheld funds again. Israel also withheld clearance funds from the Palestinian Authority when the latter resorted to international organizations for accountability/recognition. This was the case when the PA resorted to the United Nations to recognize the State of Palestine and when the PA also resorted to the UNESCO and for the International Criminal Court (ICC) for membership.

Israel also deducts from these funds in exchange for financial dues required from the PA. And so, in the past, Israel made deductions for the treatment of Palestinian patients in Israeli hospitals and for the dues of the Israeli electricity and water companies that benefit the Palestinians. This is even though these are services that the occupying power is obligated to provide to the population in the lands it occupies.

We want to highlight two issues here:

The first: If we assume that Israel’s claim– that its deduction of Palestinian clearing funds curbs Palestinian attacks – is correct, does this justification allow Israel to deal with money that is “not” its own?

Indeed, several human rights organizations have considered the law in its current form a crime of an international nature, whereby the law decriminalizes the occupation’s practices, legitimizes the occupation’s seizure of the clearance funds, and grants it legal immunity.

This law is illegal because the clearance funds are Palestinian money, and Israel’s role is only limited to collecting it, without having the right to seize or deduct anything from it. The enactment of this law therefore is a violation of Israel’s obligations, under the agreement signed between the Palestinians and Israel, which invested the PA with the power of providing all humanitarian and social services to the Palestinian population.[5]

The second is: is it illegal for the PA to pay allowances/salaries to the families of the Palestinian martyrs and prisoners?

The official legislation that requires the PA to pay the salaries of martyrs and prisoners dates to 2004, when the Palestinian Legislative Council issued a law at the time (Law No. 19 of 2004), stipulating in its Article 3/3 that the Authority guarantees the financial rights of prisoners. In statements to the Palestinian Prime Minister, Muhammad Shtayyeh, he said that his government is committed to paying the full allowances for the families of martyrs and prisoners. He specifically said: “We will remain loyal to the martyrs and prisoners, the land and our national project, in order to achieve our full rights”.

In fact, international conventions, in particular the Fourth Geneva Convention, (Articles 81 and 98), allow prisoners to receive subsidies/aid from the state of which they are a national.

In addition, we find that this Israeli law, as well as its provisions and justification, a type of collective punishment that Israel pursues against the Palestinians and the PA in retaliation for the latter’s assistance of the Palestinian families of martyrs and prisoners and to force the PA to stop providing this assistance. But International law criminalizes collective punishments that affect the rights of large groups of society.

International conventions, in particular the Fourth Geneva Convention, (Articles 81 and 98), allow prisoners to receive subsidies/aid from the state of which they are a national

Also, this law directly affects the legal status of Palestinian prisoners, in clear violation of the Third Geneva Conventions (regarding the rights of prisoners of war) and the Fourth (regarding the rights of detainees). The latter, obliged Israel not to amend the legislation that has been in force in the Occupied Territories before the Israeli occupation, except in cases of military necessity.

Accordingly, what is in principle correct is that Palestinian prisoners should be subject to the Palestinian criminalization and punishment rules. It also should be asserted that, in international law, there is no other characterization of those arrested during armed conflicts other than prisoners of war or detainees. Therefore, calling prisoners “terrorists” and criminalizing the provision of aid to their families is beyond what is stipulated in the said (Geneva) Conventions.

In addition, military necessity does not in any way mean violating international legal rules regarding the rights of prisoners. Article (81) of the Fourth Geneva Convention states one of these rights as follows: “No deduction from the allowances, salaries or credits due to the internees shall be made for the repayment of these costs.” Also, Article (98) of the Geneva Convention guarantees the rights of detainees and their families in situations of war. In addition, Article (27) of the Vienna Convention 1969 does not allow any treaty party to resort to the provisions of its internal law to justify this party’s violation of the treaty.

American Policies towards Palestinian Clearance Funds

On August 3, 2018, the US Congress issued the Taylor Force Act, which stipulates that the aid provided to the Palestinian Authority – which the Authority allocates to prisoners, the families of the martyrs and the wounded – should be cut from the aid provided by the US government to the Palestinian people. The law stipulates that the American government can deduct from its aid to the Palestinian Authority unless the latter stops paying the salaries of the perpetrators of attacks and their families. In addition, the act compels the Palestinian Authority to abandon/revoke every law or decree that allows compensation for Palestinian families who lose their children in violent actions carried out against Israeli or American citizens.

Earlier in 2018, the American administration stopped the financial contributions, estimated at $125 million, to The United Nations Relief and Works Agency for Palestinian Refugees (UNRWA), which brought the deficit in the Agency’s budget to $470 million. Also, the US administration stopped the support allocated to the Palestinian Authority estimated at $70 million and stopped its economic aid to the West Bank and Gaza Strip estimated at $232 million. Later, also, the US completely suspended the work of the United States Agency for International Development (USAID) in the Occupied Palestinian Territories.[6]

However, after the election of the new president, Joe Biden, the new US administration has pledged to return to the Palestinians the funds that were stopped earlier. But the return of these funds faces the obstacle of the Taylor Force Act which the new US administration affirmed its commitment to. This is knowing that this law stipulates, as previously mentioned, that the Palestinian Authority should stop paying salaries to Palestinian prisoners in Israeli prisons.

What Are the Alternatives the State of Palestine Can Seek to Confront Israel’s deduction of tax revenues?

The Oslo Accords dictated that Israel manage the collection of the clearance funds and transfer them to the Palestinians in exchange for an administrative commission. The agreement also provides for the end of the transitional status of the Palestinian Territories within five years from the signing of the Oslo Accords in 1994. However, with the implicit consent of both the Israelis and the Palestinians, the transitional status is still in effect. The agreement also does not give the PA the authority to appeal to the Palestinian judiciary and stipulates that judicial jurisdiction in matters pertaining to Israel is only concluded by the Israeli judiciary. As for issues that arise between the two parties, according to the Oslo Accords, they can be resolved by negotiation.

On the other hand, at the international judicial level, the PA has multiple options to internationalize the issue of the Clearing Funds. Resorting to the International Court of Justice is one of these options. However, the PA will face the “mutual consent” condition required by the court, a matter in any case Israel will not accept. This makes the decision of the International Court of Justice devoid of a binding force and limits this court’s authority to giving an advisory opinion, similar to that it gave on the Apartheid Wall in 2004.

Also, resorting to the International Court of Justice requires a referral by the United Nations General Assembly. Yet, resorting to the International Court of Justice might be an important step, especially, if it concludes with a ruling that requires Israel to compensate for the damages its Clearing Funds Law has inflected upon the Palestinians.

Also, the PA has the option to disengage itself from the legal obligations of both the Oslo Accords and the Paris Economic Agreement, a move that the PA can justify with Israel’s failure to abide by the terms of those two bilateral agreements. This option is especially viable because those two agreements entail mutual obligations between the Palestinians and Israel and give one of the two parties the option of disbanding from the agreements without any legal consequences in the event that the other party violates the terms of the agreements. This legal option finds its legal foundation in Article (60) of the Vienna Convention 1969. The article allows any party to waive its legal obligation towards the other as long as it does not abide by the bilateral agreement’s terms.

[1] Taxes on the wages of Palestinian workers in Israel are not considered part of the clearance funds. The clearing process itself relates to the exchange of goods and takes place through the customs declaration for the goods. But the statistics of the Palestinian Ministry of Finance considers the taxes on Palestinian workers as a kind of clearance funds; and after an Israeli deduction of 25%, it transfers this tax into this ministry’s treasury every three months. See, “freezing clearance funds, a recurring crisis and long-term economic effects” by Nu’man Kanafani and Salam Salah, published at The Socio- Economic Monitor, by The Palestinian Economic Policy Research Institute, Mas, 2015.

[2] Direct and indirect taxes were included in the amendment of the Paris Economic Protocol on 9/28/1995. See Paris Economic Protocol, available at:<https://bit.ly/38W3qNP>, the Economic Policy Research Institute, MAS.

[3] See, Al Mezan Center for Human Rights, the Legal Aid Unit, A Legal Report on the Israeli Law Pertinent to Freezing Funds from the Palestinian Authority’s Tax Returns, 2018, P.3

[4] See Haneen Hmaiss, “The Impact of Clearing Funds on Tax Revenues in Palestine, (1995-2005)”, Master Thesis, An-Najah University, Nablus, 2006, p. 80.

[5] United Nations Conference on Trade and Development, UNCTAD, Palestinian financial revenues going to Israel under the Paris Economic Protocol, New York, 2014, p. 39.

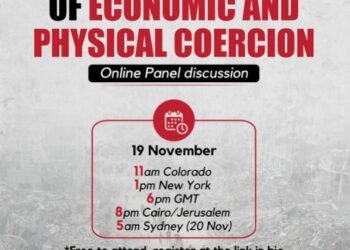

[6] See, Mazen al-Ajlah, “Israeli piracy on Palestinian clearance funds, contexts, options, and repercussions”. A working paper submitted to a panel discussion entitled “Power and the political and economic implications of deducting the entitlements of the martyrs and prisoners”, The Palestinian Center for Policy Research, Masarat, 5/3/2019.

—

Yousef Al-Ashqar: Palestinian lawyer, academic, and legal and political researcher. He has published several legal and political papers, and is specialist in the International Criminal Court and Palestine. Al-Ashqar is a PhD candidate in law, his thesis entitled “Implementing the International Criminal Court Judgments before the National Cours, challenges and obstacles.”